Take Home Salary For 12 Lakhs

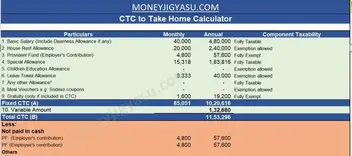

Step 1 Download our Excel Calculator Tool and enter your CTC breakup as per the offer letter in the Input Sheet. Take-Home Salary Gross Pay Total Deductions.

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

You are eligible for a home loan of approximately Rs.

Take home salary for 12 lakhs. Leave travel allowance LTA House rent allowance HRA Other allowances etc. Monthly in-hand take-home or net pay salary. During my campus placement days I had few of my friends who were offered a CTC of 12 lacs pa.

The calculator is updated for the Financial Year 2020-21. Minimum Take home salary - 1019340. PPF Insurance ELSS FD NSC etc Section 80 C Deduction 150000.

Your in-hand salary can include the following Basic salary. As per law the employer can choose to only pay the 12 of 15000 if the monthly basic pay is more than 15k. Home Loan Interest or House Rent Allowance Section 24 and.

But eventually when they calculated the take home salary there was a marginal difference in both of them. Without tax deduction your net earning will be 74124 per month. 36 Lakh if your in-hand salary is Rs.

Investment in NPS Section 80 CCD 1B 50000. Professional tax varies from state to state but we approximate it to Rs200month. Take Home Salary Calculator India Excel Tool How to Use Just follow the simple steps below to calculate your take home salary from CTC using this excel calculator.

What will be the in hand take home salary for 24 lakhs CTC offered by TCS wherein 1 lakh is retention incentive. Take-Home Salary Rs 750000 Rs 48600 Rs 701400. Minimum Monthly Take home salary - 84945-The takehome salary will increase if the tax liability decreases.

Less - Income tax TDS - 134960. Take Home Salary Gross Salary - Income Tax - Employees PF ContributionPF - Prof. Take home salary -Gross Salary - 1178400.

Less - Profession tax - 2500. However during my next job I made sure to inquire about the take home salary. Contribution of NPS By Employer Section 80 CCCD 2 150000.

Additionally the table shows if your salary is Rs 15 LPA you can save up to Rs 15600 if you switch over to the new tax regime. This is of course assuming that you are claiming full exemption us 80 C and also availing the standard deduction of Rs 50000 to save tax on salary. Pay Zero Tax for Income up to Rs 12 Lakhs from Salary F Y 2017-18.

Basic Salary 40000 HRA 16000 Tax free with HR calculation Conveyance 800 Tax free Medical Allowance 1250 Tax free with bills Food Coupons 1500 Tax free LTA 6667 Tax free Medical Insurance1000 Tax free Employers contribution to Pf 4800 Tax free Bonus 3333 Variable Performance Based Pay 15000 15 of CTC. This will help you understand a typical salary structu. It will be in the region of Rs83000 on an average as take home every month After deductions like provident fund gratuity medical professional tax and income tax.

Looking for 30 lakhs finance. Subtract the Income Tax Provident Fund PF and Professional Tax from the Gross Salarydetermined in step 1. An employer can choose to pay more than 12 too but I have not heard of any being extravagant.

Also we have not included variable pay and income from other sources. If my CTC is 12 lacs per annum what will be my take home salary if I use all possible ways to minimize my tax. Most private sector good companies like TCS Infosys HCL Accenture etc.

Without ExemptionsDeductions the tax calculator shows those earning Rs 12 lakh annual income will have to pay Rs 119600 as tax as per the new. Now your earning after these two deductions is 90680017316 889484 lakhs per year. Monthly it will come as 1443 and yearly it will be 17316.

Less - PF Contribution - 21600. Do pay 12 of actual basic pay. Gross monthly income might be much more than INR 50000 per month.

Now divide it by 12 you will get 74124 per month. Bank only considers your in-hand salary. Hey GuysIn this new video we break down an average salary 25 LPA of a Tier 1 MBA school in India.

Real Estate property cost. Take home salary Gross Salary - Income Tax - PF - Professional tax Note. Calculate Take Home Salary.

While others were just offered 9 lacs pa. Need to know basic and variable pay to calculate it. You dont have any other personal or car loan on your name.

If you have invested in Public Provident Fund Employees Provident Fund Sukanya Samriddhi Scheme life insurance or health insurance premium tax-saving fixed deposits from banks or post offices or any other provisions that allow tax exemption to the tune of Rs 15 lakh you would still stand to lose Rs 31200 in tax saving for income above 15 lakhs by following. Response 1 of 12. If you invest up to 15 lakh.

Calculate your in-hand salary.

Ctc Vs Actual Take Home Salary I Reality Of 25 Lakh Package In India Youtube

What Will Be My In Hand Salary If Ctc Is 2 30 Lakhs Quora

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

Difference Between Ctc And Take Home Salary Explained Ndtv Intraday Trading Currency Note Small Business Loans

5 Tricks Played By Employers To Fool You With High Ctc Salary

Akshay Tritiya Special Offer From The Kothari Wheels Rs 1 Down Payment For Any Favourite Maruti Car Down Payment Offer Special Offer

Pin On Vacancy Admit Card Result Answer Key Exam Analysis

Average Salary In Sweden 2021 The Complete Guide

Salary Calculator 2020 21 Take Home Salary Calculator India

What Is The Take Home Monthly Salary For 12 5 Lpa Quora

Software Engineering In Nepal Best Software Engineering Collage In Nepal Where To Study Software Engine Computer Science Degree Software Engineer Online Jobs

What Is The Take Home Salary For A Ctc Of 14 Lpa Quora

Taxable Income Calculator India Income Business Finance Investing

Here S A Financial Guide For Couples In Mid Thirties With Income Of Rs 2 5 Lakh Per Month Businesstoday

How Much In Hand Can I Expect If Getting 12 Lpa As Fixed Salary Quora

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

If My Ctc Is 12 Lacs Per Annum What Will Be My Take Home Salary If I Use All Possible Ways To Minimize My Tax Quora

If My Ctc Is 12 Lacs Per Annum What Will Be My Take Home Salary If I Use All Possible Ways To Minimize My Tax Quora

Post a Comment for "Take Home Salary For 12 Lakhs"